The idea is to get ahead with your tools. Leading POS purchasing plans for the next few years include researching new POS solutions (51%), adding new modules to current systems (46%), and deploying POS for mobile devices (39%). (POS Software Trends Report, 2019).

This POS system is ideal for retail operations, including supermarkets, spas, and salons. It can also serve as a restaurant POS software solution.

1st Pay POS System Review – Company Overview

Fort Worth, Texas-based First American is an industry-leading payment technology system that has launched 1stPayPOS Pro. They have over 25 years of experience providing integrated payment systems for 210,000+ customers.

Owned by Texas based Forth Worth, It is a leading payment technology system company. They have more than 210000 customers. Their point of sale software is geared toward the retail and restaurant industries and offers cloud-based functionality, multiple hardware options and a wide range of business management tools. Its inventory management capabilities are especially strong and more comprehensive than those of competitors. They allow you to add a description, image, manufacturer’s suggested retail price or MSRP, your selling price, discounts and taxes, tags, stock-keeping units or SKUs, brands, categories and custom fields.

A good POS can make your day-to-day operations much more efficient by streamlining and automating key tasks, such as ordering, reservations, payments and inventory management. It can also provide greater insight into your business’s performance, such as sales trends and top-performing employees.

Some POS systems offer integrated payments certified using EMV and mobile payment solutions like Apple Pay, as well as advanced security hardware and software. Other features include bill splitting, tip management, a cash drawer with an electronic opening sensor and the ability to apply multiple tax rates by item category.

Upserve is a POS system for small restaurants, including coffee shops, delis and bakeries, that includes inventory management features such as vendor management, one-click purchasing and low-inventory alerts. It also supports recurring transactions and has a built-in online store to maximize online sales. Its pricing structure is transparent, with a flat swipe fee and competitive interchange pricing for card processing.

Their product includes a robust set of in-store, online, and mobile solutions. It’s paired with the latest payment security that spans a wide range of verticals. They’re backed by award-winning customer service and intuitive technology that functions on every business level.

1st Pay POS Benefits

Cloud-based functionality with multiple hardware options.

- Built-in inventory management system with powerful analytics and reporting.

- Comprehensive security solutions with PCI compliance.

- Deep analytics with merchant and partner reporting.

- In-store solutions that include EMV and loyalty programs.

1st Pay POS Pricing

The 1stPayPOS pricing is structured to allow you the flexibility in setting a price that works for your business. The fees are quote-based and set by vendors. Fees, although not transparent, may include:

- Set-up fee (one time)

- Monthly license fee (per register)

- 1stPay transaction fee (any transaction run through the POS system)

1st Pay POS System Requirements and Capabilities

First American provides a POS system with both payment and business management functionalities. Their intuitive POS is divided into a few platforms to service niche markets. These include:

- Restaurants

- Retail

- Salons

- E-commerce

- Government

- Non-profit

1st Pay POS also provides integrated payment solutions with comprehensive developer tools. This enables a business to quickly add solutions to their platform for more efficient processing.

1st Pay Platform

First American has intentionally designed the software to be scalable and future-proof. It grows with your business.

In addition to functionality, the 1st Pay POS platform is built with security in mind. Their comprehensive suite of features is available for in-person, mobile, and virtual payments. Some of the key benefits to this product include:

- Tokenization

- EMV payments

- Fraud detection tools

- Point-to-point, end-to-end encryption

- PCI compliance

In addition to the payment platform, First American also offers these products:

Integrated Payments

First American presents a comprehensive integrated payment solution for independent software vendors and developers. It’s a significant opportunity for ISVs to update their current platform and add another stream of revenue. Here are some of the benefits this program provides:

- Rest API – 1stPayBlaze is a SaaS full-stack payment processing API. It’s just a snippet of code!

- Credit Card Vault – 1stPayVault stores all your credit card processing data and customer information. It allows you to keep the information securely on their servers, not yours.

- Recurring Payments – Whether it’s weekly, monthly, or quarterly, the recurring payment solution provides an easy and automated way to accept payments.

- Account Updater – 1stPayMaximizer is a popular product for partners and merchants. Update credit card information automatically and reduce the number of credit declines.

In-Store

Terminal Solutions – Machines built custom to fit every business owner’s needs. Whether it’s a mobile terminal, EMV, or PIN pad, they can provide it.

- EMV Solutions – 1stPayPOS EMV solutions presents transactions to customers in a new way. This includes EMV and Contactless (NFC) terminals, EMV Mobile Reader, EMV-capable terminal, and semi-integrated EMV solutions.

- POS Solutions – The 1stPayPOS Pro tablet point of sale solution.

- Gift and Loyalty Programs – FirstAdvantage™ gift and loyalty program offers in-house gift card processing and loyalty solutions directly to customers.

Mobile Payments

- 1stPayMobile – Process EMV and contactless payments quickly and securely using any mobile device or tablet from any location.

E-Commerce Payments

- Shopping Cart – Design your own commerce website. The solution comes with business and marketing management tools to help grow revenue quickly.

- Payment Page Builder – The Hosted Payment Page Builder product allows you to quickly and easily build a page that is consistent with your website. The goal is to be able to accept payments or donations online, at any time.

- Virtual Terminal – FirstPay.Net™ is a secure and reliable suite of e-commerce solutions that was developed for any type of merchant. Design your own e-commerce website and create shopping carts to drive sales.

Security Solutions

1stPaySecure – A built-in suite of security tools to protect your customer data. This includes everything from data breach technology to PCI compliance and fraud prevention.

1stPay Secure is an inbuilt security system that protects customers data, prevents against a data breach and makes the payment process much more secure. It is designed to make the transaction process more efficient and provide better service. The payment security systems are certified annually against PCI compliance by a Qualified Security Assessor.

This payment processing software monitors transactions and detects suspicious activity that can help merchants spot warning signs of an attack. It also helps merchants understand the threats they face so they can take steps to prevent them.

It protects the customer’s personal information, including name, address and phone number, when it is stored in the device. It uses a unique Device Account Number and encrypts it, protecting it from unauthorized access even if the device is hacked. It can only be decrypted with a special key that only the device’s payment network or its providers authorized by the card issuer for provisioning and token services have.

A safe and secure payment gateway is critical for nonprofits to earn and transfer donations. Nonprofits are especially susceptible to a type of fraud known as “card testing.” When a credit card is stolen, criminals often test whether the card works by making fraudulent donations to nonprofits. A safe and secure payment gateway can help prevent these fraudulent transactions from happening, saving the organization money on chargeback fees and preserving the donor’s trust. It also provides peace of mind to donors who have their information stored with the nonprofit for recurring payments.

- Encryption – The Point-to-Point, End-to-End Payment Tokenization and Encryption converts credit card data to unreadable code that is resistant to fraud and data hacks.

- Data Breach Protection – The North American Data Security RPG Policy is designed to provide protection to credit card processing companies, acquiring banks, ISOs and their merchants for the common financial liability risks.

- PCI Compliance – PCI Smart helps merchants validate PCI compliance and combat any costly breaches. When you comply with security measures on their behalf, your customers feel safer making credit card purchases.

Analytics and Reporting

- Merchant Reporting – FirstView provides reports and statements online from any device.

- Partner Reporting – The Daily Dashboard is the online partner reporting tool that does everything from processing applications to instant alerts and portfolio management.

- 1stPayInsights – A powerful business analytics tool that combines data from sales, marketing, social media, customers, etc.

Additional Solutions

1stPayPOS also has additional solutions that add value to your system. These include:

- Cash Advances

- Check Solutions

- ACH Solutions

- ATM Solutions

- American Express OptBlue

- Next Day Funding

Hardware

1st Pay POS provides many hardware options to support the software. Here’s a breakdown of their equipment:

Android Tablet – 10” or 15”

- Barcode Reader / Scanner

- Payment Devices with EMV

- Wireless Router & Access Points

- Multi-register/location management

You can purchase a cash drawer, printers (FOH and BOH), and a POS stand. There is the option to purchase the 1stPayPOS Pro Line Buster.

It comes with an Insignia 32 GB Tablet (black) with a 10.1” LCD screen. You can also purchase the Ingenico iPP320 PIN pad that supports EMV acceptance.

Hardware can be bought in three separate packages:

Package #1 – 10”

1stPayPOS Register 10” (tablet and stand), thermal printer (Epson T-20), iPP320 PIN pad, cash drawer, and cables.

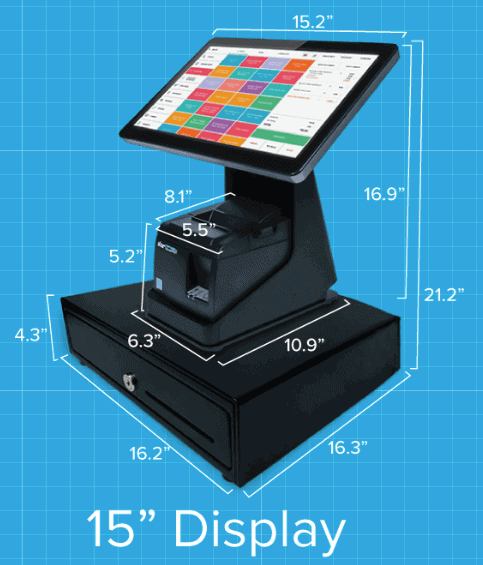

Package #2 – 15”

1stPayPOS Register 15” (tablet and stand), thermal printer (Epson T-20), iPP320 PIN pad, cash drawer, and cables.

Package #3 – All-in-One

All-in-One unit (with an integrated tablet, stand, printer, and cash drawer), iPP320 PIN pad, and cables.

1st PAY Customer Service & Support

First American has a U.S.-based, 24/7/365 customer call center that provides round-the-clock support. FirstView and Daily Dashboard are both customer portals you can log into to manage your system. Additional resources include:

Blog

- Infographics

- Videos

- White Papers

- FAQs

The installation process has a lot of support. This is in three phases:

Pre-Installation Call

- Review configuration topics

- Advise next steps

Merchant Set-up Review

- Email to merchant/owner

- Follow-up items for configuration

Installation and Training

- Formal installation and training

- Occurs after system delivery to the merchant

The Final Say

First American that owns 1stPayPOS not only provides custom solutions, they also issue tools to developers. It’s a flexible point of sale system designed for a variety of markets and sales verticals.

Whether you are trying to analyze consumer behavior or run extra-encrypted transactions, it’s a solution ahead of the game that can easily fit into any style of operations.

Cloud-based functionality with multiple hardware options.

Cloud-based functionality with multiple hardware options. Terminal Solutions – Machines built custom to fit every business owner’s needs. Whether it’s a mobile terminal, EMV, or PIN pad, they can provide it.

Terminal Solutions – Machines built custom to fit every business owner’s needs. Whether it’s a mobile terminal, EMV, or PIN pad, they can provide it. 1stPaySecure – A built-in suite of security tools to protect your customer data. This includes everything from data breach technology to PCI compliance and fraud prevention.

1stPaySecure – A built-in suite of security tools to protect your customer data. This includes everything from data breach technology to PCI compliance and fraud prevention. Android Tablet – 10” or 15”

Android Tablet – 10” or 15” Blog

Blog