If you’re looking for a simple, easy-to-use POS system for your small business, both SumUp and Square are solid options. Both systems will help you accept payments faster, build loyalty programs, and, ultimately, increase your profitability.

SumUp and Square POS both offer the hardware, software and payment processing that let small businesses take payments in person or through invoices. Both systems are easy and simple to use, with low installation costs and a range of reliable hardware options. However, Square's deeper set of features might make it a better fit for some companies.

Both systems have a similar sign-up process, with the only real difference being that SumUp allows you to connect its card reader via Wi-Fi rather than using your smartphone's mobile data, which might save you on mobile data charges if you operate a small business. Both systems also have a good level of customer support, with phone and email support available for paid plans.

Square's fee structure is slightly cheaper than SumUp's, with in-person transactions costing 1.75%, compared to 2.9% plus 15C for online (payment links, QR codes and invoices) and keyed-in (card-on-file) transactions. Both providers have no setup fees or monthly costs, but Square does charge a $0.25 per-transaction fee on card refunds.

While Square is a more established company that offers a range of extra features, its platform is robust enough to support the needs of most small businesses. It's especially suitable for those that want fully functional point-of-sale systems, sizable touch-screen displays and complex reporting capabilities. In contrast, SumUp focuses on microbusinesses, first-time entrepreneurs and freelancers, making it a solid choice for companies that prioritize keeping transaction processing costs as low as possible.

SumUp is a basic payment processing system geared toward new and small businesses. They offer transparent pricing, a number of reliable hardware options, and a painless setup process. They offer gift cards and payment links, as well as the ability to accept all kinds of payments: credit, debit, EMV, contactless, and more.

Square is one of the most widely used POS systems on the market, due to its quick setup and ease of use. Square is known as the POS system for small stores and operations, as it doesn’t offer too many features out of the box. However, in recent years, Square has upgraded their offerings and tools and aim to cater to businesses of every size.

In our research for the SumUp vs. Square comparison, we found that Square outperforms SumUp due to its more expansive features: menu or catalog management, custom receipts, on-site refunds, and a customizable dashboard and screen.

When it comes to pricing, SumUp offers a competitive rate of 2.75% per swipe, chip, or contactless payments, with higher rates for remote payments or invoicing. There are no monthly costs to use their payment processing service, although they charge a $19 one-time cost for a card reader.

However, Square gives you a better bang for your buck. They charge 2.6% + $0.10 per transaction. The platform itself, as well as the initial hardware you need to get started, is offered free of charge, although there are plenty of options to upgrade your hardware.

Both platforms are solid payment processing systems, although Square will offer you more POS features. Let’s dive into each provider’s features, pricing, and support.

Quick Overview of Each Provider

SumUp and Square are both highly popular mobile POS providers that drive business in the UK and the United States. Both are known for straightforward fees, a user-friendly environment, and mobile payment processing.

Although Square has virtually cornered the American market for a decade, SumUp has expanded into the space to compete. Each platform is a separate payment service provider, which means they allow business owners to process payments without the need for a merchant account.

The funds are then distributed to each individual bank account accordingly. This makes it easier and faster for a business to sign up for an account and start accepting payments.

SumUp

Today, hundreds of thousands of companies around the world rely on SumUp to get paid.

Square

SumUp VS. Squre: Side-by-side Comparison

| ||

|---|---|---|

| POS Software | but options available for a fee. |

|

| Payment Processing | (2.95% + 15 cents per virtual terminal). | (3.5% + 15 cents for manual entry). |

| Hardware | ||

| Operating System | ||

| Analytics and Reporting | ||

| Employee Management | ||

| Customer Service | ||

| Integrations | ||

| Security |

KEY FEATURES

SumUp Features

- Magnetic stripe

- EMV chip

- Apple Pay and Google Pay

- Contactless (NFC)

SumUp is a top financial solution in European countries. It boasts a straightforward mobile app that allows a business to accept payments, track sales, and take orders in an all-inclusive EMV terminal and single POS platform.

Square Features

Square Features

Although Square offers several POS and payment processing products, the free system has a viable approach to basic business management. The additional countertop-based hardware enables business owners to operate their POS system like a traditional register setup.

Hardware

SumUp and Square both offer unique options for hardware.

SumUp Hardware

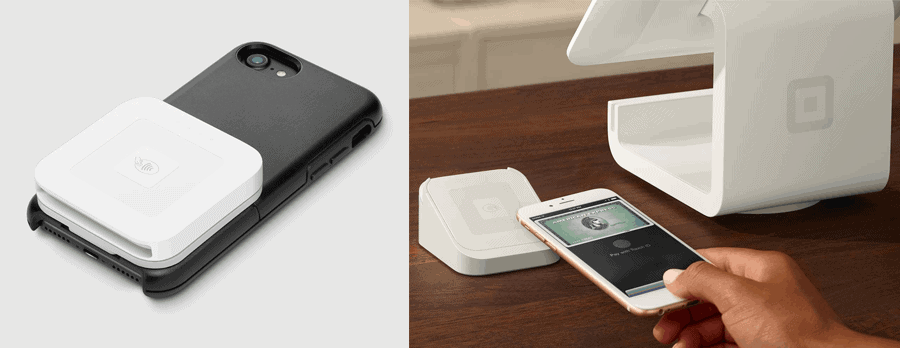

SumUp makes it slightly easier by offering one terminal to process all card types. The company has handled chip payments for years and their EMV experience shows in the hardware.

Tap, swipe, and chip with the SumUp Card Reader to get paid every time. The hardware connects with any mobile or tablet device using Bluetooth technology. The system can process over 500 transactions on a single charge and accepts all major debit and credit cards.

The card reader is the first fully certified EMV mobile POS system in the world and comes equipped with NFC and an integrated Li-ion battery. You can accept international cards that display one of the four major network logos. This will require the cardholder to pay a currency conversion fee as well.

The mobile card reader is PCI compliant and can be charged using a micro USB cable. You can also continue running transactions while the device charges. You even have the option to manage multiple readers under one SumUp account.

Square Hardware

To date, Square has launched over 5 different devices for card payments. Two of these will only accept the Swipe platform: Square Stand and the original magstripe Square Reader. Here are your options for hardware:

- Square Reader for Magstripe – Accept swiped card payments via iOS and Android.

- Square Reader for Contactless and Chip – This is the most comparable to SumUp equipment. Accept chipped, tapped, and swiped payments.

- Square Stand for Contactless and Chip – Built to support an iPad and includes the Square Reader.

- Square Terminal – An all-in-one POS solution that accepts all payment types.

- Square Register – Fully functional POS system that includes a touchscreen and stand.

The Square hardware ranges in size and functionality and is designed to accommodate a range of businesses.

It is important to note, the card reader must have access to wi-fi to work. It will not process transactions while offline.

Software

SumUp Software

- Accept and track cash payments

- Create, manage, and customize inventory (including a product catalog)

- Set up and manage tax rates

- Refund transactions

- Send customer receipts

The system also allows a company to create and track employee accounts, download custom reports (like sales and revenue), and view transaction/sales history. You can even accept “card not present” payments using the virtual terminal.

Square Software

Compared to the SumUp app, the Square platform is much more expansive in terms of features, tools, and functionality. This is what makes it work for a business of any size. It can be used for everything from processing sales to tracking and managing inventory.

Additional features include:

- Create a menu or catalog with custom categories

- Customized text, email, and printed receipts with an option for feedback

- Accept swiped card payments offline or enter them manually

- Process refunds, send custom invoices, and store cards on file

- Completely customize your dashboard and checkout screen

The Square app also allows a business to effectively manage inventory, view advanced analytics, and integrate add-ons for team management.

Ultimately, the SumUp app provides the basic capabilities needed to accept orders and process payments. The Square POS platform offers extensive features that a smaller business may not need.

Cost

Here is a breakdown of SumUp vs. Square costs:

|

||

|---|---|---|

| Card reader | ||

| Charging dock | ||

| Swipe, insert & tap fee | ||

| Keyed transactions | ||

| Invoice payments | ||

| Instant transfers | ||

| Chargebacks | ||

| Refunds | ||

| Monthly costs |

Square Costs

The cost of using Square can be complex depending on the hardware you use, and the features added on. For hardware, it breaks down as such:

Square Reader for Magstripe – Free

- Square Reader for Contactless and Chip – $49

- Square Stand for Contactless and Chip – $199

- Square Terminal – $299

- Square Register – $799

Processing Fees

2.75% + 10 cents for any transaction that is:

- Contactless payment

- Swiped magstripe card

- Swiped or inserted chip card

- Prepaid gift card

- Swiped using the virtual terminal

3.5% + 15 cents for any transaction that is:

- Manually entered

- Made with a card on file

- Manually entered in the virtual terminal

2.9% + 30 cents for any transaction that is:

- Square invoices

- eCommerce products

SumUp Costs

Square offers chargeback dispute services for free while SumUp costs $10 per chargeback. This is lower than the average industry rate of $25.

When it comes to refunds, they are free for both platforms when done straight away. Square is free for up to 120 days while SumUp will keep the transaction fee.

Customer Service and Support

Since Square is a larger company, they tend to have more complaints online than SumUp. There have also been some issues with the way Square handles account terminations. If they close your account, it is sent via email with no option to appeal the decision.

Both platforms offer phone, email, and chat support, however, Square makes a business go the extra mile to get someone on the phone. Unlike SumUp, Square offers an extensive self-service knowledgebase, Twitter support, and a community forum.

In Conclusion

Whether you choose SumUp or Square depends on a variety of factors. SumUp is designed for a smaller business that may not require all the bells and whistles Square offers. Although the platform doesn’t have as many resources as Square, their customer service seems to be much more on point when resolving issues.

Conclusion

A large chunk of SumUp’s positive reviews come from small business owners and solopreneurs who appreciate the card reader’s affordability, simplicity and mobility. Users also seem to love the fact that there are no long-term contracts or monthly fees. That said, many people are a little disappointed that the provider does not offer more features and tools such as custom reporting or integrations with other software.

The SumUp system comes with a single all-in-one card reader, offering a range of ways to accept payments including mobile payment links, invoicing, key payments and a virtual terminal. The provider is also working on a business bank account that will be available soon and may add more advanced features in the future. However, a lack of live chat and support tools means that if you have any issues with the hardware or software, you will only be able to get in touch during business hours. This makes it less ideal for more ambitious businesses that need a payment processor that will allow them to serve customers around the clock.

The company does have an online Support Center that answers most common questions, but customer service is only available by phone from Monday through Friday between 9 AM and 7 PM EST or via email for less urgent queries. Depending on the nature of your query, it can take days or even weeks to receive a response. This is one area where SumUp does not measure up to other competitors such as Square and Zettle.

If there is no need for complex processes, SumUp is your answer. However, it is not an easy platform to achieve growth. If you plan on building and driving business, Square might be a better option.

Square Features

Square Features

Square Reader for Magstripe – Free

Square Reader for Magstripe – Free