Stripe has helped millions of companies use their API to accept payments online and take control of their business management. More than accepting simple payments, Stripe allows you to send invoices, issue virtual or physical cards, manage your transactions, and more.

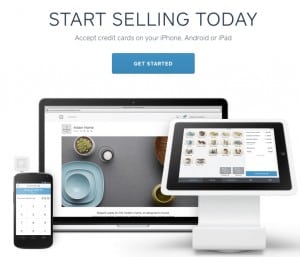

Square is a complete point of sale solution for retail businesses and restaurants. By using Square, you can sell your products online or in-store. Square provides its own hardware components. The software is easy to use and the setup time is exceptionally fast when compared to Stripe’s hardware.

In our research for Square vs. Stripe, we found Square to be the better overall option. While Stripe is a reliable solution when it comes to online payments, it is not a true point of sale software solution like Square. Additionally, Stripe charges 2.9% + 30¢ while Square charges just 2.6% + 10¢ for online payments. Being a true POS solution and the lower processing costs make Square a better solution.

Simply put, Stripe has only recently integrated in-person payments as a solution. However, if you’re planning to run an e-Commerce store exclusively, Stripe might be easier and faster to integrate with your website. It was built specifically for online payments, and so the infrastructure is able to support these sales.

Both providers integrate with CMS platforms like Magento, WordPress, and others. If you need to set up recurring payments, Stripe is the better option. As far as reporting goes, both systems have in-depth, custom reports you can generate on the fly. This includes viewing total sales, disputes, returns, your account balance, and more.

When it comes to support, we found Stripe’s staff to be more accessible and the hold times were much shorter. However, both providers offer solid support around the clock.

Let’s dig deeper into our review of both online payment providers and see which one fits your business’ needs.

Stripe vs. Square: Quick Provider Overview

Stripe and Square have a lot in common. They are both developer-friendly platforms that come with a lot of flexibility. The innovative city of San Francisco is home to both brands.

Stripe

Stripe

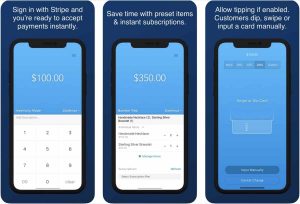

Stripe is a financial services and SaaS company that primarily offers payment processing software and application programming interfaces (APIs) for e-commerce and mobile apps. The brand offers card readers to work with the software in both a physical and mobile fashion.

Financial service and software as a service company

Stripe offers payment processing software for online businesses. Buyers enter their financial information into a purchase page and the software verifies funds and processes the transaction before sending it to the merchant account. The business then sends a receipt to the customer.

Using APIs, developers can add Stripe to their ecommerce platform or mobile app and enable customers to make credit card payments. They can also use Stripe to accept ACH bank payments, mobile wallets such as Apple Pay, and buy now, pay later financing services like Affirm.

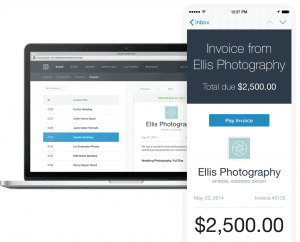

For businesses, Stripe offers billing, invoicing, and identity protection services. Its billing software lets users create recurring charges and set up schedules for when to charge customers. A fee of 0.5 percent applies to recurring charges. The tool also helps users track subscription revenue and customize billing statements.

In addition, Stripe’s Connect platform enables marketplaces and platforms to pay sellers and service providers globally. Its features include a customizable onboarding process for sellers, flexible payout timing, complex money movement capabilities, and integrated financial reporting. The pricing starts at 0.25 percent of the account’s transaction volume.

Using Stripe’s dashboard and API, business owners can see all of their charges, pending deposits, refunds, and fees in one place. They can also access structured data with SQL to analyze and report on their business, including customer details such as plans, balances, and payment history. In addition, Stripe has built prebuilt integrations to reliably connect with dozens of business applications and systems from CRM and sales tools such as Salesforce and Docusign to ERP and accounting platforms like NetSuite and Xero, and data warehouses such as Snowflake and Redshift.

Square

The name “Square” comes from the free, square-shaped reader that is what led to the brand’s initial popularity.

Stripe vs. Square: Side-by-Side Comparison

|

||

|---|---|---|

| POS Software | but options available for a fee. |

|

| Payment Processing | (3.5% + 15 cents for manual entry). |

|

| Online Payments | ||

| Hardware | (additional hardware starts at $49). |

|

| Operating System | ||

| Analytics and Reporting | ||

| Employee Management | ||

| Customer Service | ||

| Integrations | ||

| Security |

Payment Processing

The main reason for using either platform is for payment processing.

Square focuses on letting merchants accept card payments where you can add support for online and mobile wallets. However, the software is lacking ACH support.

Stripe allows merchants to accept a host of localized payments favored in different parts of the world. Additionally, for online payments you can add Apple Pay on the web or other mobile wallets.

Developer Tools

Square has two e-commerce APIs: Transactions and Checkout. Square Checkout consists of a pre-made form that can be pasted into a site with minimal effort. This means merchants are eligible for some perks like chargeback protection and next-day deposits.

The Transaction API is more customizable. Additionally, Square supports:

- iOS

- Android

- Flutter SDKs

- App-based payments

Stripe Checkout generates a pre-built form you can drop into a site with a few lines of JavaScript. In addition to web and in-app payments, Stripe has a host of APIs for other functions. So if you have a motivated developer, this platform might work best.

Integrations

Square makes it easy for a business to engage in e-commerce (even without using the API). Weebly is what they offer for a simple, affordable site-building option.

The list of integrations also includes some of the best shopping cart apps on the market. It’s an omnichannel solution for vendors that wish to sell anywhere without the need for complex integrations or coding work. The advantage here is that you can get set up quickly and selling instantly. After you import products and adjust the settings, everything is ready to go.

- Texts

- Emails

- Social media posts

The button allows the buyer to purchase your product, donate, or transfer money straight to your business. It is currently only available in the United States.

While Square makes it simple, Stripe dominates with the vast amount of integration offered. In addition to major e-commerce software partners, the Stripe developers have created an assortment of plug-ins for organizations running on sites like Magento, WordPress, and more.

Stripe also offers robust integrations to take recurring payments—particularly ACH payments. Although Square has advanced reporting, it pales in comparison to the power of Stripe Sigma, an SQL-based reporting tool. If you run a company heavily incumbent upon metrics, this might be a suitable platform.

Merchant Financing

Stripe Capital and Square Capital are remarkably similar. Rather than applying for a loan, both platforms will automatically extend an offer to any qualifying customer through the dashboard.

While the two brands call the product a loan, it functions more along the lines of a merchant cash advance. That means you repay the loan through the payment processor itself. A small percentage is taken from your credit card sales until you’ve made good on the amount, plus a flat fee.

A few differences include:

- Stripe Capital is faster with next day delivery of funds.

- Square Capital provides more upfront details about the service.

Additional Services

Both payment processors offer other popular features like:

Square

Square Appointments

- Multilocation Management

- Advanced Reporting

- Team Management

- Loyalty Program

Stripe

- Radar fraud detection

- Virtual cards for mobile wallets

- Automation toolset for payouts

- Stripe Billing

- Atlas for international business

Hardware

Square and Stripe have similar terminals, but Stripe tends to be more complicated. Here is a brief comparison of the main hardware they offer:

Fixed Terminals

| Internet Connection | ||

| Card Technology | ||

| Online/Offline | ||

| Push-button Keypad | ||

| Touchscreen | ||

| Terminal Checkout | ||

| Works with POS? |

Only the mobile reader can be set up without code (using a third-party app). The Verifone terminal needs to be manually programmed with a POS software plug-in (a set of APIs and SDK).

Another main difference is that the Verifone model works with 4G, so a company is never limited to a local wi-fi network. This means Stripe can literally be used anywhere. Although Square boasts the same connectivity, you need to be hooked up to a local wi-fi network to employ the platform.

Mobile Terminals

When comparing the mobile hardware of both brands, there are also key differences:

(swipe and chip/contactless) |

||

|---|---|---|

| Internet Connection | ||

| Card Technology | ||

| Online/Offline | ||

| Keypad | ||

| Display | ||

| iOS/Android App | connect with third-party apps. | Can also use third-party apps. |

The main thing to remember about the two platforms is that Square hardware is simple and comes optimized while Stripe equipment is something that needs programming.

Software

Stripe’s Software

- Product library

- Send e-receipts

- Save details in a customer database

- Process refunds

- Tipping

Although several features are like Square, Stripe’s offering is more simplistic. However, detailed functions like product management are better organized.

Square’s Software

- Inventory management

- Staff controls

- Payment processing

- Marketing

- Reporting and analytics

The software platform can be downloaded on both iOS and Android devices.

In comparison, the Stripe app provides the basics needed to accept orders and process payments. The Square platform offers extensive features that a smaller business may not need.

Costs

Here is a breakdown of Stripe vs. Square costs:

|  |

|

|---|---|---|

| Card Reader | ||

| Countertop Terminal | ||

| Monthly Fee / Setup Fee | ||

| Online Payment | ||

| Card Terminal | ||

| Additional App Fess | ||

| International Card Fee | ||

| Currency Conversion Fee | ||

| Instant Payouts |

Stripe and Square fees are similar except for when it comes to in-person payments. In this case, Stripe has more costs involved. However, online payments typically charge the same.

There are no additional Square fees for currency conversion, premium cards, or international transactions. It should also be noted that if you choose Stripe’s mobile card reader with a ready-made payments app, there can be an extra transaction fee with that third-party. Therefore, transparency is lacking.

Integrating a Stripe reader with a uniquely designed app should not incur app-based transaction fees, but there could be additional costs that are unexpected. Square, on the other hand, has no such app fees. It is completely free to use the point of sale system with the Square Reader. The same goes for the Square Terminal software.

Payouts

Both Square and Stripe offer automatic payouts to your bank account, yet Stripe’s processing time is less predictable. While Square advertises “next-business-day” transfers, deposits can take up to two days to clear. If you activate the “Instant Transfers” features, money will be received within a few hours.

The Stripe payout schedule, however, relies on several factors. The brand takes into consideration things like:

- Industry

- Country

- Risk involved

The first payout will take 7-10 business days, but subsequent transfers will be faster. It should also be noted, if Stripe considers your business “high-risk” payments may also take a much longer time.

Online Payments

- One-off invoices

- Marketplace solutions

- Subscription/billing based on usage, location, type, and other factors

- Trial preceding a subscription

None of these features are ready. It requires a professional developer and/or robust integration tools. However, if you’re using it for an online store, it can connect straight to an ecommerce platform (without the need for a developer).

- Integrated online store

- Email invoices

- Keyed-in payments (in POS app)

- Virtual terminal (phone and mail order payments)

There is no coding required for any Square online payment. All are, by default, free through paid e-commerce plans.

Customer Service and Support

Since both platforms are aggregators, customers can be subject to random and/or frequent account holds. This means you don’t get a unique merchant account (like the ones provided by acquiring banks). Instead, payments are received through a pooled account. So, although it is fast to open an account, it is also riskier.

While Stripe has 24/7 customer support, Square is committed to office hours via phone and email. Additionally, both platforms boast an extensive knowledgebase for self-empowerment.

Square’s Customer Support

Square operates a robust Seller Community for online interaction with your peers. Discuss everything there is to know about the platform with people in the same boat as you. Gather answers from other merchants, as well as Square support reps who monitor the page.

Square offers a robust customer support, which includes a troubleshooting section that covers everything from figuring out how to use your card reader and troubleshooting issues with the system itself. In addition to this, there are also video tutorials that walk you through common problems and how to fix them.

The Support Center can be found within the Square Seller Community, which is a massive online forum for merchants who use the company’s services to sell their products and/or services. The forum is a great resource for questions and concerns, and Square’s staff is pretty active on the forums as well.

If you have any feedback from your customers, you can view this on the Customer Directory in your online Square Dashboard or by logging into the Associate app and selecting a transaction with that customer. Your customers can choose whether their experience was satisfied or dissatisfied, and you can reply to their feedback with a coupon or message.

When you select a customer in your Customer Directory, you can see their full contact information including their email address. You can also upload a list of contacts into your Customer Directory in bulk using the online importing tool.

You can restrict which team members have access to your customer directory in the online Dashboard by enabling or disabling the View, Edit, and Create Directory Data permission. Once this is enabled, only those with the permission can access the directory and any information associated with it.

Additionally, the Square team watches “Stack Overflow” for questions related to products and services. However, there are customer complaints about the quality of support. The bigger the business, the harder it is to reach people.

Overall, the largest complaint comes from merchants whose accounts were terminated. Not only do you simply receive an email, but the company cuts off access to phone support. So, if there is a mistake, your business could suffer.

For a while, Stripe lagged in customer service and support. However, these days, the platform is viewed as a competitive solution in this space. They did a lot of work to improve and it shows. They also maintain a self-service knowledgebase much like Square’s (although not as extensive or detailed).

Stripe also employs a freenode IRC channel (#Stripe) and after years of comments about interpersonal merchant relationships, they now offer 24/7 customer support for all. Although it has not eliminated everything, it improves the customer service experience overall. If you have a larger business, Stripe also offers premium support packages.

Our Final Verdict

In summary, both platforms will suit a business well. Square is built more for a company that is just starting out. Stripe is geared towards enterprise ventures and online pursuits. Each platform offers similar solutions so it may boil down to how your developers deem the open API workable.

These software programs are pliable. Do what you want with them but first, know what you are doing. A little research goes a long way before making big decisions. Once you have chosen a solution, check into the proper integrations to make it a well-oiled machine.

Stripe

Stripe Square Appointments

Square Appointments