Click here to visit our YouTube channel and be sure to like, subscribe, and comment to let us know what you think!

How Businesses Can Adapt to Survive

As the economic landscape continues to evolve, businesses face the challenge of navigating through rising interest rates and their impact on business credit. The Federal Reserve’s decision to raise interest rates in response to inflation has significant implications for businesses seeking financing. In this article, we will explore how rising interest rates affect business credit and discuss strategies for businesses to overcome these challenges.

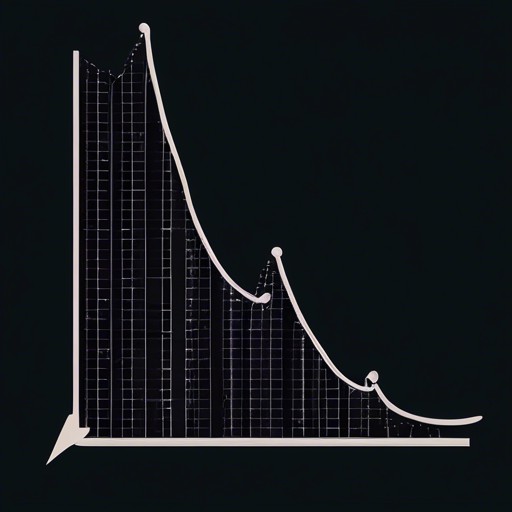

Understanding the Impact of Rising Interest Rates & Declining Short-Term Lending

Interest rates serve as a critical factor in determining the cost of borrowing for businesses. When interest rates rise, the cost of borrowing increases, making it more challenging for businesses to access affordable credit. This can have far-reaching consequences, including limiting cash flow, reducing access to short-term credit, curbing consumer spending, and making financial planning more complex.

Limiting Cash Flow

One of the immediate impacts of rising interest rates is the strain it puts on a business’s cash flow. With higher interest costs, businesses may find themselves allocating a larger portion of their cash reserves to cover interest payments. This leaves fewer resources available for investment in long-term growth or day-to-day operations, potentially hindering a business’s ability to seize opportunities or maintain stability.

Restricted Access to Short-Term Credit

As interest rates increase, not only do long-term loans become more expensive, but short-term financing options such as business lines of credit and business credit cards also become less accessible. Higher interest rates can make it more challenging for businesses to qualify for these types of financing, as lenders may require higher credit scores or impose stricter repayment terms. This can leave businesses struggling to bridge cash flow gaps or handle unexpected expenses, potentially stunting their growth and limiting their financial flexibility.

Curtailed Consumer Spending

When interest rates rise, individuals face higher costs for servicing their existing debts, such as student loans, car loans, and mortgages. This increased financial burden often leads to reduced disposable income and a decrease in consumer spending. Depending on the industry and customer base, businesses may experience a decline in demand for their products or services as consumers prioritize essential expenses and cut back on discretionary purchases. This can directly impact a business’s revenue and sales, making it crucial for businesses to adapt their strategies to attract and retain customers during periods of rising interest rates.

Complex Financial Planning

Businesses heavily rely on financial planning to set goals, allocate resources, and make informed decisions. Rising interest rates complicate financial planning by introducing uncertainty into interest rate projections. Businesses with variable-rate loans may experience fluctuations in their interest expenses, making it challenging to accurately forecast future financial obligations. This highlights the need for businesses to regularly reassess their financial plans and consider strategies to mitigate the potential impact of rising interest rates.

Strategies to Navigate Rising Interest Rates and Preserve Business Credit

While rising interest rates present challenges for businesses, there are several strategies they can employ to navigate this changing landscape and preserve their business credit. By proactively addressing these challenges, businesses can position themselves for long-term success.

Evaluate and Optimize Debt

An essential step for businesses is to evaluate their current debt and assess its impact on cash flow. By understanding the terms and interest rates of their existing loans, businesses can identify opportunities to optimize their debt structure. For example, refinancing existing loans to secure more favorable interest rates or exploring debt consolidation options can help businesses reduce their overall borrowing costs and improve their cash flow.

Diversify Funding Sources

Businesses should consider diversifying their funding sources to reduce their reliance on traditional bank loans. Exploring alternative financing options such as factoring, asset-based lending, or crowdfunding can provide businesses with additional avenues for raising capital. Diversifying funding sources not only helps businesses overcome potential constraints imposed by rising interest rates but also strengthens their financial resilience by spreading risk across multiple sources.

Strengthen Business Credit

A strong business credit profile is essential for accessing favorable financing terms and maintaining financial stability during periods of rising interest rates. Businesses should focus on building and maintaining a positive credit history by making timely payments to suppliers, lenders, and creditors. Monitoring business credit reports regularly to identify and address any inaccuracies or discrepancies is also crucial. Additionally, establishing solid relationships with vendors and suppliers who report on-time payments to credit bureaus can help businesses strengthen their credit profile.

Embrace Innovation and Technology

Innovation and technology play a crucial role in helping businesses adapt to changing market conditions. Businesses should explore opportunities to leverage technology to streamline operations, improve efficiency, and reduce costs. Embracing digital solutions for financial management, cash flow forecasting, and customer relationship management can provide businesses with a competitive edge and enhance their ability to navigate the challenges posed by rising interest rates.

Seek Professional Advice

Navigating the complexities of rising interest rates and their impact on business credit requires expertise. Businesses should consider seeking professional advice from financial advisors or business consultants who specialize in helping businesses adapt to changing economic conditions. These professionals can provide valuable insights, recommend tailored strategies, and offer guidance on managing debt, optimizing cash flow, and preserving business credit.

Bypassing Bad Credit: Alternative Financing Options

In addition to the challenges posed by rising interest rates, businesses with bad credit face additional obstacles when seeking traditional loans. However, there are alternative financing options available to bypass bad credit and secure the funding needed for business growth.

Invoice Factoring

Invoice factoring is a flexible financing solution that allows businesses to unlock the cash tied up in their accounts receivable. Instead of waiting for customers to pay their invoices, businesses can sell their unpaid invoices to a factoring company at a discount. This provides immediate cash flow to the business, helping to bridge gaps caused by bad credit and improve liquidity. Invoice factoring is based on the creditworthiness of the business’s customers, making it an accessible financing option for businesses with bad credit.

Merchant Cash Advance

A merchant cash advance is another alternative financing option that can provide businesses with quick access to capital. In a merchant cash advance, a business receives a lump sum payment upfront in exchange for a percentage of future sales. This financing option is based on the business’s projected revenue, rather than its credit score, making it an attractive solution for businesses with bad credit. However, it’s important to carefully review the terms and fees associated with merchant cash advances, as they can be higher compared to traditional loans.

Crowdfunding

Crowdfunding platforms offer businesses the opportunity to raise funds from a large number of individuals who believe in their product or service. By creating a compelling campaign, businesses can generate financial support from a community of potential customers and supporters. Crowdfunding allows businesses to bypass traditional lending institutions and access capital directly from their target audience. However, successful crowdfunding campaigns require careful planning, effective marketing, and a strong value proposition to attract backers.

Grants

Grants

Grants can be an excellent source of funding for businesses, particularly those in specific industries or demographics. Various government and private organizations offer grants to support small businesses, startups, and entrepreneurs. While grants may have specific eligibility criteria and application processes, they provide non-repayable funds that can help businesses bypass the need for traditional loans. Researching and applying for relevant grants can be a fruitful avenue for businesses seeking funding with bad credit.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual lenders. These platforms facilitate loans without the involvement of traditional financial institutions. Peer-to-peer lending can provide businesses with access to capital from individuals who are willing to lend based on their evaluation of the borrower’s creditworthiness and business potential. This alternative lending option may offer more flexible terms for businesses with bad credit compared to traditional banks.

Innovation and Adaptation: The Key to Surviving Rising Interest Rates

In a challenging economic environment characterized by rising interest rates, businesses must embrace innovation and adapt their strategies to survive and thrive. By proactively addressing the impact of rising interest rates on business credit, exploring alternative financing options, and leveraging technology, businesses can position themselves for long-term success. While the road may be challenging, businesses that are nimble and willing to adapt have the potential to overcome obstacles and achieve their growth objectives.

Grants

Grants