What is Mortgage POS (Point of Sale) Software?

Mortgage point of sale software is a powerful digital tool for your company that can help you streamline your loan application process and provide a more modern experience for your borrowers. This type of software can be used on a variety of devices, including tablets and desktop computers, and provides a simple and effective way to leverage automation and deliver relevant quotes, pricing, and products to borrowers. The digital experience is increasingly important to prospective borrowers, and the most successful lenders are leveraging this to drive revenue.

Mortgage POS helps you streamline your activities as a service provider and provides borrowers with a modern home buying experience. It provides a robust system to manage loan applications which can be accessed via desktops or mobile devices allowing borrowers to complete their entire application in one sitting. Additionally, it allows borrowers to upload documentation and communicate with their lenders through secure web-based portals enabling them to stay updated on the progress of their loan application. This helps reduce processing times which enables you to offer borrowers the loan products they are looking for in a timely manner. It also enables you to leverage the power of automation thereby decreasing costs and increasing efficiency. Mortgage POS has features that enable you to track compliance requirements and monitor documents like Truth in Lending statements, appraisals and more for easy tracking of regulatory requirements. Borrowers are increasingly becoming interested in home ownership and a mortgage point of sale software provides them with the ability to connect with their lender digitally. Mortgage POS software is an essential tool for lenders to deliver a borrowing experience that meets the demands of today’s borrowers. In this competitive environment, a mortgage POS solution is quickly becoming “table stakes” or a basic necessity for lending companies to provide borrowers with an efficient borrower experience. However, not all mortgage POS solutions are created equal, and choosing the right one is crucial to your business success. This guide will walk you through the key elements to consider before selecting a POS mortgage solution for your company.What is a Mortgage Point of Sale Software?

What are the Benefits of a POS System for a Mortgage Company?

Our review team had discussion with a Mr. Smith, a Senior Mortgage Advisor and Real Estate Authority with over 20+ years of experience in the mortgage industry to gain better insight as to how implementing a point of sale software has helped his team. “A robust mortgage POS software for loan origination companies can streamline your customer interaction process and help you close more loans”, Mr. Smith stated. Mr. Smith informed us that in the last few years, there has been a rapid shift in the industry toward a more digitally interactive user experience for both loan originators as well as borrowers. Not only is a web based experience much more interactive for the customer, but it enhances efficiency for the LO team and ensures industry compliance.

These systems are designed to help you manage the entire customer-facing mortgage loan lifecycle from application to funding. With customizable features and unlimited sites, these solutions allow you to collaborate with third parties and deliver real-time data updates. They can also be integrated with third-party software and services, which is beneficial for businesses that are in the process of expanding.

With a mortgage POS software, you can focus on enhancing customer experiences and increasing your revenue. A powerful platform will allow you to streamline the entire process and streamline the borrower experience. Using a POS solution, potential borrowers can initiate contact with you and upload documentation to their application. Moreover, you can customize your mortgage POS software and add additional sites if needed.

Using POS for mortgages allows you to handle lead capture and management from the pre-qualification stage to the full application. You can collaborate with third parties in this process, allowing you to move applications through the funding phase more quickly. The system will also integrate with trusted partners and deliver real-time data updates for mortgage applications.

When using a point of sale software, your company team can automate the underwriting process. By integrating with a loan origination software, your POS can generate instant credit pulls and perform risk analysis. A POS software can also integrate with the mortgage CRM. By incorporating point of sale mortgage software, you can engage borrowers in the loan application process through a seamless digital experience. It makes the loan application process more efficient and offers the borrowers a digital experience that can be customized to their needs. By utilizing a point of sale system, your borrowers will feel involved in the process from the first moment they visit your site. The POS system can help you to manage the customer relationship better. Better customer relationship management translates into increased market share and referrals.

Using POS software for mortgage company will help you increase the productivity of your staff. The right system will help you streamline the loan application process in house and make it more seamless for your borrowers. It will also improve the efficiency of your workflow, which is essential for the success of your business. With a more efficient workflow, your business will be able to optimize loan cost effectiveness. A POS system can also reduce the overall cost of loan origination and servicing, making your bottom line more profitable.

Features to Look for in Mortgage Point of Sale

There are several different systems available on the market for mortgage lenders to choose from. However, any system that you decide to utilize should have a few core components in order for your business to gain the most from utilizing the software. Some key features to look out for when searching for the right software for your company include:

- 1003 Loan Application

- Secure Web Based Borrower Portal

- All-in-One Pipeline Management

- Workflow Optimization

- Industry Wide Integration Tools

- Digital Signature Capabilities

- Automated Loan Paperwork and Tools

- Customization Options

What is the Best Mortgage Point of Sale Software?

Based on these crucial features that are needed for an optimal mortgage point of sale software, we have determined that Floify is the best point of sale option available that is specifically designed for the mortgage industry.

Mortgage point of sale software enables homebuyers and lenders to connect, communicate, and collaborate on loan applications. It streamlines the loan process by automating communication between mortgage stakeholders, providing a best-in-class interview style loan application for borrowers and real estate agents, storing documents in a secure online repository, and facilitating electronic signatures for increased efficiency and improved borrower engagement. The best POS system for mortgage industry is Floify, a top-rated LOS and Mortgage POS. Trusted by mortgage professionals nationwide, Floify offers a fully digital experience for borrowers and real estate agents with an easy-to-use interface to take loan applications, collect and verify borrower documentation, track the loan process, and communicate with both borrowers and realtors. Using a cloud-based platform, Floify provides a seamless and convenient workflow that reduces paper usage, improves accuracy, and increases the speed of decision making. LOs need mortgage POS systems to offer modern borrowers the type of borrowing experience they've come to expect. Mortgage POS is rapidly becoming "table stakes", or a necessary tool for modern mortgage originators to provide a competitive advantage and maximize loan profitability. A Mortgage POS system allows for a more organized and efficient lending process by streamlining communication between staff members, homebuyers, and realtors, enabling faster turnaround times and reducing errors. The systems also enable lenders to increase loan volume and revenue potential by increasing their ability to handle more applications at one time.Why Do LOs Need a Mortgage POS?

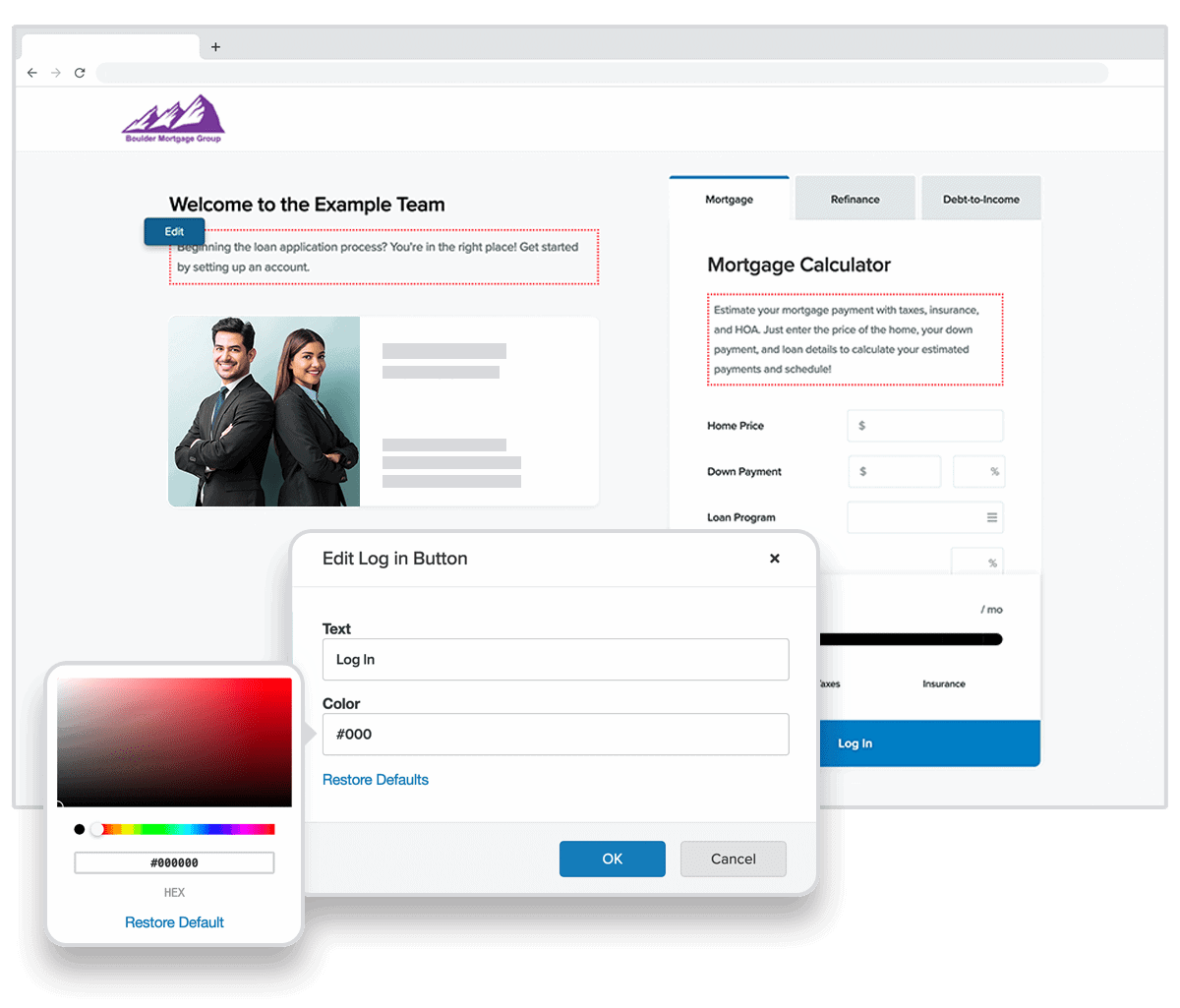

Floify’s customization options really set them apart from other competitors out there. Customization is extremely important for branding and marketing. The portal within Floify’s platform is completely customizable. The data fields and layouts can be tailored to the information that you need to gather from lenders and borrowers.

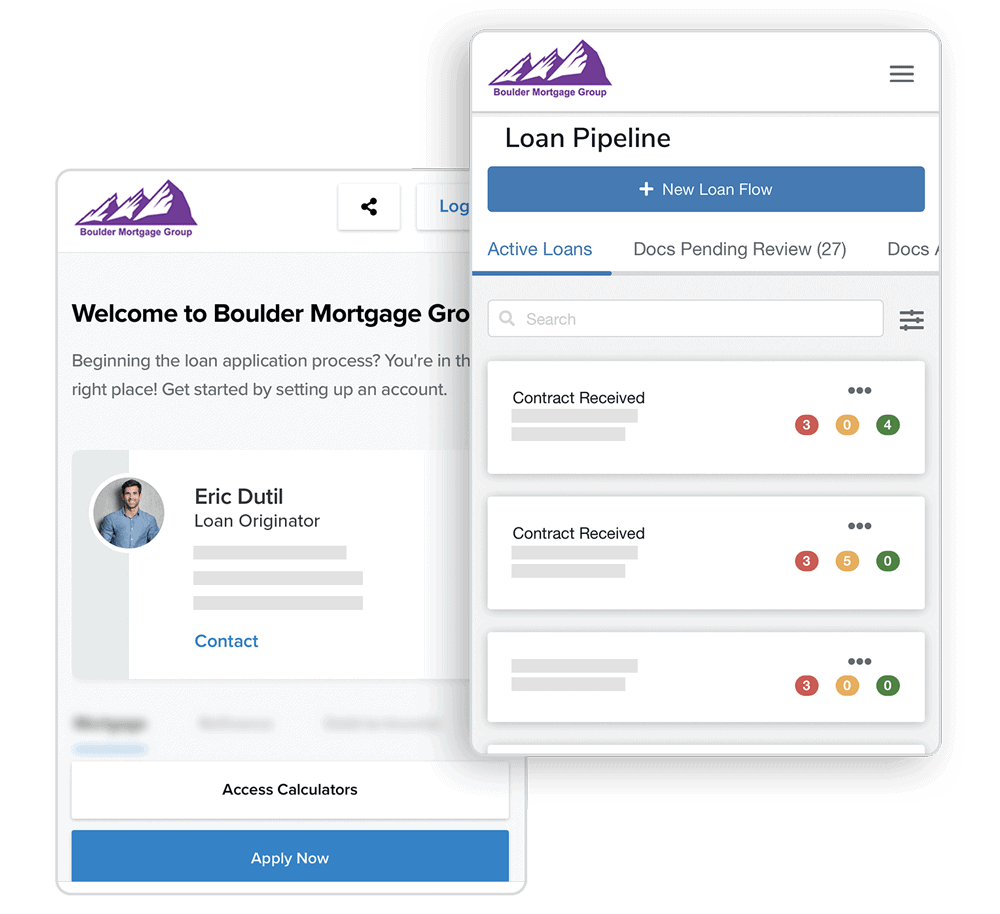

In addition, there is an option to design your own mobile progessive web app (PWA). What this feature allows for is configuration of your own app name and logo within Floify so that your borrowers are able to access your mobile PWA from their device of choice at any time to monitor documentation and loan status. The options for customization are limitless on this platform, and make the application process a breeze.

Your LO’s will thank you for integrating Floify into their workspace, as the loan document management features will make their jobs a little bit easier. The needs-list can be uploaded to the portal making it viewable to the borrower and updates will be synced for all parties to view. The documentation can be collected in a quick manner with more accuracy in once centralized and secure digital platform location.

While all of these features available from Floify are certainly impressive, what makes their services receive our top recommendation is the affordability of their platform. If you are a small mortgage lender with only one LO, your team can take advantage of the basic business plan for only $79/month. There is a team plan available that will support a single LO and up to 4 other team members working on the same pipeline for $250/month. If you are a larger company with several loan originators, you can reach out to Floify for a custom quote to suit your business needs.

(1) Floify Success Story (2022)