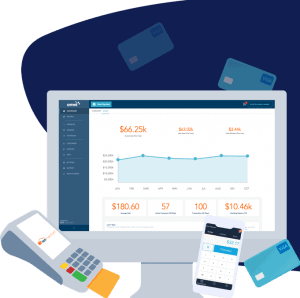

*Note: Since the time of this review Fattmerchant has been purchased by STAX.

If you’re looking for ways to increase your profitability by processing purchases faster, look no further than Square and Fattmerchant. Both POS and payment processing systems allow you to seamlessly and quickly accept payments at a payment station, on mobile devices, or through online invoicing.

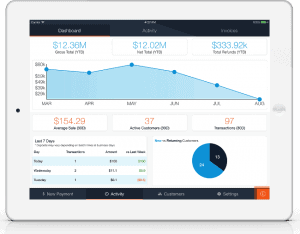

Fattmerchant focuses on providing exceptional merchant services, with features including card-present payments, mobile payments, invoicing, eCommerce, business reporting and analytics, and an API for direct integration with other platforms. They also provide customer tracking throughout all stages of their lifecycle, team management, and per-product sales reports.

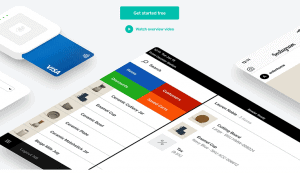

Square is perhaps the most popular POS system on the market, mostly due to its fast setup and ability to accept payments with ease. The streamlined platform has essential features like secure payments, inventory management, loyalty programs, loyalty programs, CRM, and more.

In our Fattmerchant vs. Square comparison, we found that Fattmerchant is better for companies selling high-ticket items and conducting a large volume of transactions, while Square is better for smaller businesses. This is because Fattmerchant offers a flat rate payment processing subscription, while Square charges a percentage fee off each transaction.

If you process more than $80,000 annually, Fattmerchant charges a flat $99 per month (plus $0.08 per transaction). This works out to less than 1.5% per transaction, which is a total steal. For companies that sell less than $80,000, they charge 2.9% + $0.08 per transaction.

Square, on the other hand, charges 2.6% + $0.10 per transaction. This is a much better per-transaction rate for businesses accepting smaller purchases, but it really adds up once you start to scale.

Both platforms also allow for integration with popular apps like Quickbooks for expanded functionality. Let’s dive into the features, pricing, and support offered by both companies.

Quick Overview of These Two Providers

Fattmerchant

Square

Fattmerchant vs. Square: Side-By-Side Comparison

|

||

|---|---|---|

| POS Software Starting Price | but options available for a fee. |

|

Payment Processing | + 8 cents per transaction (+ 15 cents for manual entry). | (3.5% + 15 cents for manual entry) |

| Hardware | that come with subscription. | (additional hardware starts at $49). |

| Operating System | ||

| Analytics and Reporting | ||

| Employee Management | ||

| Customer Service | ||

| Integrations | ||

| Security |

Fattmerchant Features

- Management systems

- CRM

- Inventory and stock management

- Accounting

- And more…

Reporting and Analytics

The Difference Between Reporting and Analytics

The first thing you need to understand is that reporting translates data into information, while analytics transforms that information into insights. While reporting alerts people to what is happening and how it might affect them, analytics provides insights into why things are the way they are and what can be done to improve performance. Reporting is the collection, collation and dissemination of information relating to the business environment. It enables enterprises to monitor their online business and provide insights to decision makers. It includes data visualization, consolidation and organization, and standardized formatting of reporting output. It also enables self-service and ad hoc responses through real-time reporting solutions. A good example of this is a dashboard that displays all relevant KPIs in a concise, clear and structured manner. It allows users to drill deeper into a specific area of the dashboard to view the information in more detail and offer more context. A good rule of thumb is to limit the number of KPIs displayed to no more than three to six, as too many can lead to decision fatigue and overwhelm. A good example of this is system process maps (or flows) that describe the end-to-end sequence of a given business process. They identify bottlenecks and help uncover opportunities to solve problems to bring the business from its current sub-optimal state to a better future state. The results of these analyses are presented to decision makers to facilitate discussions and find solutions that will ultimately bring value.Online Payments

Send invoices and tokenize customer information with the online payments feature. Not only does this function well for service businesses, but the shopping cart feature enables a brand to set up an e-commerce store.

Mobility

Access the business anytime, from anywhere, and grab a convenient view of the data you need. The mobile-friendly dashboard provides access to users to manage all locations in one place and delegate important tasks.

Square Features

Paperless Transactions

Accept payments using Android or Apple smartphones and tablets. The Square system automatically stores digital receipts.

Intelligent Reporting

Manage Inventory

Sign into the Square dashboard from anywhere to manage inventory. You can download reports on stock, order quantities in bulk, and receive daily alerts by mail. The system even allows a vendor to quickly import thousands of products via a CSV spreadsheet.

Email Marketing

Send automated emails to your list for more targeted marketing. Set up welcome emails, birthday offers, and more to establish strong customer relationships. The system lets you create new profiles at the POS to build your directory. Square also provides custom templates and a distribution list for easier emailing.

- Invoice sending and tracking

- Booking and scheduling

- Employee management

- eCommerce

- Accounting and tax

Hardware

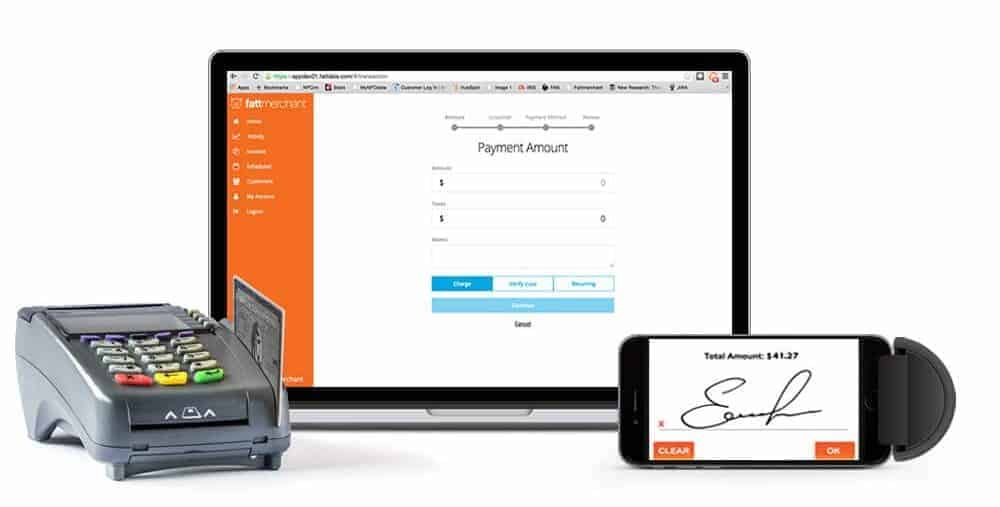

Fattmerchant Hardware

Fattmerchant meets with each customer prior to programming the equipment to determine exactly what you need. Simply tell them what you want, and the terminal arrives ready to go.

Fattmerchant also has Bluetooth readers that can attach to your phone or tablet. Swipe or insert a card to complete a transaction in seconds.

Square Hardware

- Square Reader for Magstripe –swiped card payments via iOS and Android.

- Square Reader for Contactless and Chip –chipped, tapped, and swiped payments.

- Square Terminal – An all-in-one that accepts all payment types.

- Square Register – Fully functional system that includes a touchscreen and stand.

- Square Stand for Contactless and Chip – Built for iPad and includes the Square Reader.

Please note, for the Square Reader to work you must have access to wi-fi. It will not run transactions offline.

Software

Fattmerchant Software

Whether it’s locations, tools, or solutions, Fattmerchant software allows you to manage multiple data points across your entire network. The Omni Company Overview Report helps a company accurately plan for the future.

Square Software

The Square software platform can be downloaded on both iOS and Android devices and used with any Square device (except the Square Register which comes with software).

- Customized text and printed receipts

- Store cards on file, send invoices, and process refunds

- Robust staff scheduling and management

- Accept cards offline and online

- Create a menu or catalog with custom categories

The Square app also allows a business to view advanced analytics, manage inventory, and integrate add-ons to streamline operations.

Cost

Square Costs

- Square Reader for Magstripe – Free

- Square Reader for Contactless and Chip – $49

- Square Stand for Contactless and Chip – $199

- Square Terminal – $299

- Square Register – $799

Processing Fees

- 2.75% + 10 cents for any transaction that is swiped, tapped, contactless, virtual, or gift card.

- 3.5% + 15 cents for any transaction that is manual, on file, or entered virtually.

- 2.9% + 30 cents for any transaction that is through invoicing or e-commerce products

Fattmerchant Costs

The reason for a subscription-based model is that Fattmerchant does not charge an interchange fee. This is a non-negotiable rate set by card brands like Visa and Mastercard. They are variable on a number of factors including whether the card is credit or debit, how the payment is made (swipe or tap), and if the card is rewards or corporate.

Most payment processors include the interchange rate in the processing cost, so you never know what you are spending per transaction. Fattmerchant charges a monthly subscription to get the lowest rate possible.

The cost per transaction will change depending on the subscription you choose. These break down as such:

Customer Service and Support

Square offers the same level of support. However, since the brand has been around longer, they tend to have some complaints. This is especially apparent when it comes to the account termination process. When your account is closed for any reason, you are sent an email with no option to appeal.

Square answers all queries via phone or email. The 24/7 support center offers tons of materials like:

- POS tips

- Articles

- Guides

- FAQ

- Videos

There is also a seller community where you can interact with peers.

The Final Take

Choosing between Fattmerchant and Square may just boil down to the size of your company. When running high-volume transactions, a subscription-based model like Fattmerchant tends to save money. You are not being nickeled and dimed for every card that is run.

However, this can also be costly for a business that may only process a few transactions per month. If you are on the smaller end of the business spectrum, Square might be the best choice. The amount saved through Fattmerchant may not be enough to offset the subscription cost.

Fattmerchant is an a la carte service while Square is more inclusive. So, take that into consideration when making your choice as well. How much time do you have for customization? Do you need something up and running now? Considering these factors will help you decide which platform will drive growth, improve relationships, and add to your company’s bottom line.